Sonora, CA — Tuolumne and Calaveras are two of 1016 counties designated under a new drought fast-track law to help farmers and ranchers.

The USDA also announced today that it has streamlined the disaster designation process. Agriculture Secretary Tom Vilsack says there will be a “40 percent reduction in processing time for most counties affected by disasters; a reduced interest rate for emergency loans that effectively lowers the current rate from 3.75 percent to 2.25 percent; and a payment reduction on Conservation Reserve Program (CRP) lands qualified for emergency haying and grazing in 2012, from 25 to 10 percent.”

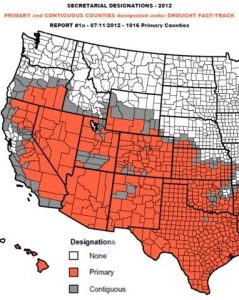

The process “Nearly automatically qualifies a disaster county once it is categorized by the U.S. Drought Monitor as a severe drought for eight consecutive weeks during the growing season.” Effective July 12, 1,016 primary counties in 26 states will be designated as natural disaster areas, making all qualified farm operators in the designated areas eligible for low interest emergency loans from USDA’s Farm Service Agency (FSA), provided eligibility requirements are met.” According to the USDA’s maps, before this went into effect Tuolumne and Calaveras were not considered 2012 disaster designated crop counties, now both are.

USDA encourages all farmers and ranchers to contact their crop insurance companies and local USDA Farm Service Agency Service Centers, as applicable, to report damages to crops or livestock loss. In addition, USDA reminds livestock producers to keep thorough records of losses, including additional expenses for such things as food purchased due to lost supplies. More information about federal crop insurance may be found at www.rma.usda.gov. Additional resources to help farmers and ranchers deal with flooding may be found at http://www.usda.gov/disaster.

USDA’s crop insurance program currently insures 264 million acres, 1.14 million policies, and $110 billion worth of liability on about 500,000 farms. In response to tighter financial markets, USDA has expanded the availability of farm credit, helping struggling farmers refinance loans. In the past 3 years, USDA provided 103,000 loans to family farmers totaling $14.6 billion. Over 50 percent of the loans went to beginning and socially disadvantaged farmers and ranchers.