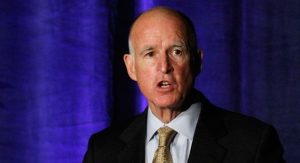

Sacramento, CA — Governor Jerry Brown has released his plan to close California’s $15.7 billion budget hole.

Brown was Tuesday’s KVML “Newsmaker of the Day”.

The Governor plans to cut spending by $8.3 billion, but is relying on the November tax initiative to pass in order to close the remaining deficit. If approved by voters, the ballot measure would increase the state’s sales tax, and bump up income taxes on those making over $250K.

“We can’t balance the budget with cuts alone,” says Brown. “The budget I am proposing will boost funding for education, protect public safety and prevent an even deeper round of trigger cuts.”

If the November ballot measure is approved, K-12 education spending would increase by 16 percent over last year. However, if it fails, education would be the first in line to take a hit.

25th District Republican Assembly member Kristin Olsen counters, “The Governor claims he is prioritizing education and public safety in his budget, yet he continues to propose that K-12 schools and higher education take the biggest hit if voters reject his tax increases on the ballot. There are other areas of the budget we can cut.”

The Governor’s Office has released the following details about his May revised budget proposal:

Increases Funding for K-12 Education

Under the Governor’s proposal, funding for K-12 education would receive an increase of 16 percent, subject to voter approval. State funding for K-12 schools would increase from $29.3 billion in last year’s budget to $34.0 billion by the end of 2013.

Keeps Higher Education Affordable for Low-Income Students

The revised budget proposes that the state award Cal Grants using the same methodology that determines eligibility for Federal Pell Grant awards. This would ensure that the neediest applicants – who constitute some 63 percent of Cal Grant recipients – continue to receive the maximum award. Students with higher family incomes will receive reduced assistance.

Protects Public Safety

The revised budget continues to fund local governments that are implementing public safety realignment. It proposes a permanent funding structure so that local governments will have a reliable funding source into the future.

Cuts State Employee Compensation Costs

The revised budget includes a 5 percent cut to state employee compensation costs. This will be achieved through a reduced workweek or a commensurate reduction in work hours and pay.

Provides Funding for Existing Homeowner and Consumer Assistance Programs

Existing assistance programs for homeowners and consumers affected by the mortgage crisis will be funded with proceeds from the National Mortgage Settlement, resulting in $292 million in General Fund savings.

Funding court budgets from alternative sources

This year’s budget restructures trial court funding, reducing General Fund support by $300 million on a one-time basis and requiring each trial court to use their available reserve. It delays court construction for a savings of $240 million and increases retirement contributions for state court employees. Altogether, these will result in $125 million in ongoing savings.

Reduces Corrections Spending

In April 2012, the administration released a comprehensive plan to save billions of dollars, end federal oversight, and improve the prison system. As a result of this plan, the California Department of Corrections and Rehabilitation expects to save $1 billion in 2012-13 and $1.5 billion in 2015-16 while satisfying the U.S. Supreme Court’s order to reduce the prison population.

The “Newsmaker of the Day” is heard each weekday morning on AM 1450 KVML at 6:47, 7:47 and 8:47am.