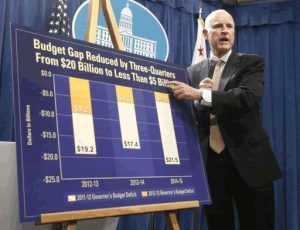

Sacramento, CA – California’s non-partisan Legislative Analyst believes Governor Jerry Brown’s tax plan would fall short of initial estimates.

The Governor’s Office has projected that raising the tax rate on high income earners, and bumping up the sales tax by half a cent, would bring in $6.9 billion annually over the next five years. LAO Mac Taylor has released a report claiming that it would bring in $4.8 billion next budget year, and $5.5 billion in the following years. The report concedes that predicting the revenue is very difficult, given that it relies heavily on high income earners, which will vary from year to year.

The Governor is planning to put the tax plan before voters in November. The tax increases would expire after five years.