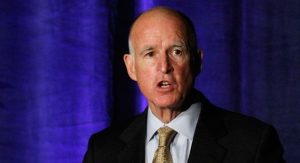

Governor Jerry Brown signed the California Homeowner Bill of Rights to halt the “abusive tactics” of loan servicers and protect struggling homeowners who are trying, in good faith, to renegotiate their mortgages.

Brown was Tuesday’s KVML “Newsmaker of the Day”.

“Californians should not have to suffer the abusive tactics of those who would push foreclosure behind the back of an unsuspecting homeowner,” said Governor Brown. “These new rules make the foreclosure process more transparent so that loan servicers cannot promise one thing while doing the exact opposite.”

“The California Homeowner Bill of Rights will give struggling homeowners a fighting shot to keep their home,” said Attorney General Kamala D. Harris. “This legislation will make the mortgage and foreclosure process more fair and transparent, which will benefit homeowners, their community, and the housing market as a whole.”

The Homeowner Bill of Rights has four major components:

• Prohibiting “dual track” foreclosures that occur when a servicer continues foreclosure while also reviewing a homeowner’s application for a loan modification;

• Creating a single point of contact for homeowners who are negotiating a loan modification;

• Expanding notice requirements that must be provided to a borrower before taking action on a loan modification application or pursuing foreclosure; and

• Allowing injunctions against foreclosure until violations are corrected and permitting civil penalties against servicers that file multiple, inaccurate mortgage documents or commit reckless or willful violations of law.

These new laws make California the first state in the nation to take provisions in the National Mortgage Settlement, which covered the nation’s five largest mortgage loan servicers, and apply those rules to all mortgage servicers.

By prohibiting dual-track foreclosure, this legislation provides borrowers with certainty that their loan application will receive full review and consideration before any foreclosure occurs. These requirements also provide the borrower with a legal remedy to challenge the actions of servicers that engage in dual-track foreclosure or other material violations of law.

The Homeowner Bill of Rights also requires a single point of contact for borrowers seeking loan modification. This requirement will make loan servicers more accountable and prevent them from repeatedly transferring applications and phone calls to various departments and employees.

Under the new law, servicers must notify borrowers when a modification application is due, if foreclosure has been postponed and if a modification has been denied. Each of these new rules increases transparency and helps to ensure that borrowers are properly informed of the actions taken by a servicer before foreclosure activities begin.

Borrowers have a right to file private lawsuits under this new law to block foreclosure until the lender corrects any material violation. Borrowers can also receive treble damages up to $50,000 if servicers act intentionally or recklessly in violating the law. These provisions protect the rights of consumers, while allowing servicers to correct unintentional violations.

The California Homeowner Bill of Rights, AB 278 and SB 900, was sponsored by California Attorney General Kamala D. Harris. AB 278 was authored by Assembly Members Eng, Feuer, Mitchell and John A. Pérez. SB 900 was authored by Senators Leno, Evans, Corbett, DeSaulnier, Pavley and Steinberg.

The law will go into effect January 1, 2013.

The “Newsmaker of the Day” is heard each weekday morning on AM 1450 KVML at 6:47, 7:47 and 8:47am.