No the sky isn’t falling…

In the Dodd-Frank Act, the Consumer Financial Protection Bureau (“CFPB”) was directed to combine the mortgage loan disclosures under the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA (. The CFPB has developed a rule for this purpose which shall take effect on August 1, 2015. The biggest question to come out of the announcement has been –

Will the new mortgage disclosures delay my closing?

The answer is NO for just about everybody. The information below is mainly from the CFPB web site.

For mortgage applications submitted on or after August 1, 2015, lenders must give you new, easier-to-use disclosures about your loan three business days before closing. This gives you time to review the terms of the deal before you get to the closing table. Many things can change in the days leading up to closing. Most changes will not require your lender to give you three more business days to review the new terms before closing. The new rule allows for ordinary changes that do not alter the basic terms of the deal.

Only THREE changes require a new 3–day review:

- The APR (annual percentage rate) increases by more than 1/8 of a percent for fixed-rate loans or 1/4 of a percent for adjustable loans. A decrease in APR will not require a new 3-day review if it is based on changes to interest rate or other fees.

- A prepayment penalty is added, making it expensive to refinance or sell.

- The basic loan product changes, such as a switch from fixed rate to adjustable interest rate or to a loan with interest-only payments.

NO OTHER changes require a new 3–day review:

There has been much misinformation and mistaken commentary around this point. Any other changes in the days leading up to closing do not require a new 3-day review, although the lender will still have to provide an updated disclosure.

For example, the following circumstances do not require a new 3-day review:

– Unexpected discoveries on a walk-through such as a broken refrigerator or a missing stove, even if they require seller credits to the buyer. (Ed. – the buyer may balk at that discovery and that could still delay the closing, but it would not be cause of these new rules.)

– Most changes to payments made at closing, including the amount of the real estate commission, taxes and utilities proration, and the amount paid into escrow.

– Typos found at the closing table.

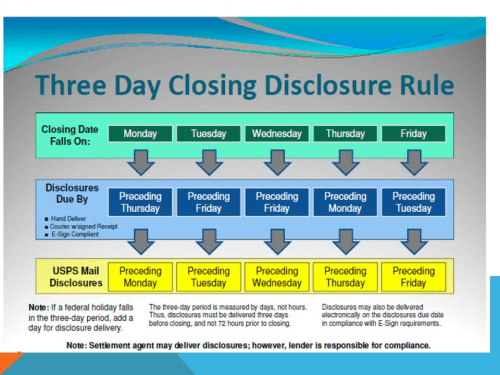

Here’s a graphic from the CFPB site that explains the timetable for getting the disclosures to the parties involved.

NOTE that these are business days and not measured in hours.

So, why all of the hubbub about these new rules? Well for one it will force changes in the mortgage underwriting process and require that the underwriters get their jobs done well before the closing date. These changes were promoted by mortgage industry practices that had gotten so bad that many buyers and sellers were not shown their closing paperwork until they arrived for the closing. Mortgage companies pared back their processing and underwriting staffs so much during the recession that they could no longer keep up with the load, once the market started recovering. These new rules will likely result in some hiring to properly staff up and support the guidelines for disclosures being given to the parties involved for review.

These new rules don’t affect the real estate process itself or the Realtors® involved, other than potentially causing delays if the requirements aren’t met by the mortgage companies. You can go to the CFPB Web site for more details on these new rules.

So, NO, the sky isn’t falling (at least not the sky over the buyers and sellers); but, mortgage companies will be scrambling to change their procedures in order to comply with these new rules. That’s a good things for everybody concerned.

Written by Norm Werner for www.RealtyTimes.com Copyright © 2015 Realty Times All Rights Reserved.