Starting today Mother Lode drivers will spend more to fill up at the pump. A 3.5-cents-per-gallon tax hike went into effect for all of California Monday, July 1.

As reported here back on March 1, the State Board of Equalization (BOE) voted to hike the excise tax to 39.5 cents per gallon. California has the highest gas tax in the nation, at 71.9 cents per gallon.

The BOE says, “While gasoline consumption had been reduced slightly in recent years, in 2011 and 2012 the price of gasoline greatly and unexpectedly outpaced these modest declines in consumption. Higher gasoline prices mean the BOE must adjust the excise tax to make up for the sales tax loss, and achieve the revenue neutrality mandated by the legislation.”

Chairman Jerome E. Horton stated in March, “The legislature mandated that we equalize the sales and excise taxes to avoid a net increase in taxes.” He added, “We could protest the legislation and not make the rate adjustment; however we would be violating law and arguably exposing taxpayers to even higher taxes in the future.” Assembly Bill x8 6 Ch. 11 and Senate Bill 70 Ch. 9, which became law in 2010, gave authority to and requires the State Board of Equalization to adjust the excise tax rate to match the sales and use tax rate on gasoline to assure the tax burden on consumers is the same.

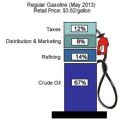

The BOE says the excise tax is charged to gasoline suppliers but it’s often passed on to consumers. Coupled with federal and other state taxes, California drivers now pay 71.9 cents per gallon in taxes for every gallon.

Statewide, the average price of a gallon of gas on Saturday was $3.97. The price of regular in Sonora is about $3.78 per gallon. In San Andreas it is about $3.88.

Gasoline sales tax revenues fund local government programs, the excise tax funds highway and mass transit projects throughout California. For a previous story, “What Makes Up The Price Of Gas” go here.