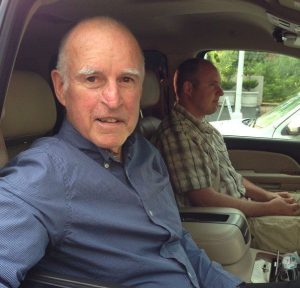

Gov. Brown Overviews 2018 Budget Plan, Others Comment

Sacramento, CA – California Governor Jerry Brown, in releasing the final budget under his tenure, says it keeps the state on a path to long-term fiscal stability, urging lawmakers to “not blow it now.”

Brown today proposed a $131.7 billion General Fund budget plan for 2018-19. As he describes it, the new budget will fill the state’s Rainy Day Fund to its constitutional goal, which is ten percent of tax revenues, through a $3.5 billion supplemental payment; fully implement the state’s K-12 school funding formula two years ahead of schedule; also funnel $4.6 billion to initialize a ten-year transportation improvement plan. Click here for the overview.

Leading off his letter to the State Legislature, Brown stressed, pointing out recent good years that have allowed for additional program spending in contrast to the state’s 2011 $27 million budget gap, which required stiff cutbacks. His proposal, he says, continues to bank higher revenues into reserves as well as pay down debts and liabilities. “California has faced ten recessions since World War II and we must prepare for the eleventh,” he stated, citing among his concerns a growing uncertainty about the impacts of new federal policies combined with a longer-than-average economic expansion.

Investing In Education

Along with $3 billion in new proposed funding for the state’s K-12 funding formula, to improve student achievement and transparency the budget proposes requiring that school districts create a link between their local accountability plans and their budgets to show how this increased funding is spent. For K-12 schools, Brown’s funding levels would increase almost $4,600 per student from the state’s 2011-12 levels.

His budget also plans for a three-percent funding boost to the UC and CSU education systems and, with no tuition increases this year, tuition costs, adjusted for inflation, to come in below 2011-12 levels. Community colleges would see a four percent increase, of which $46 million will be used to implement AB 19, allowing colleges to waive tuition for first-time, fulltime students. It also proposes additional funding incentives for achieving students’ successes. It further calls for creating the state’s first wholly online community college for wage earners to build career-growing credentials.

Other Key Funding Areas

The proposal again provides funding aimed at increasing health care coverage for low-income Californians under the federal Affordable Care Act (ACA) while continuing to implement optional expansion that will cover nearly 3.9 million Californians in 2018-19.

It covers the first full year of Road Repair and Accountability Act of 2017 funding to the tune of $55 billion in new monies over the next ten years, to be evenly split between state and local projects. It also continues to pay down what Brown in 2011 identified as the state’s accumulated $35 billion “Wall of Debt” over the previous decade, now estimated at under $6 billion.

Illuminating the cap-and-trade legislation combating climate change that he signed last July targeting the reduction of greenhouse gas emissions 40 percent below 1990 levels by 2030, Brown signaled allocations for some $1.25 billion in resulting auction proceeds and revenues that he plans to further detail during his upcoming State of the State Address.

Early Responses To Brown’s Plan

State Treasurer John Chiang praised Brown’s proposal, stating, “It promotes fiscal discipline, advances strategic growth, and builds shock absorbers in preparation for the next recession.” He added, “If budgets are, indeed, reflections of people’s priorities, I would continue to urge him and lawmakers to continue to invest more heavily in three bedrock areas that are critical to the long-term prosperity of this state: higher education, affordable housing, and early childhood education.”

State Controller Betty T. Yee, while reporting that the state’s total revenues of $16.25 billion for December were $2.79 billion above June’s budget expectations, commented, “I can sum up the governor’s budget in one word: smart. The federal tax measure did not just stick it to California’s individual taxpayers–it also likely will have a devastating impact on our state budget, which may mean less money for essential social services such as Medi-Cal, Medicare, and the children’s health insurance program.”

Board of Equalization Vice Chair George Runner remarked, “”It’s a smart move by the governor to boost the state’s Rainy Day Fund, since as he warns, the threat of a recession still looms, and California is still very much vulnerable to boom-and-bust budgeting.” Weighing in further, he opined, “However, since members of his own party are suddenly and surprisingly concerned about taxpayers, it would be great if the governor would use the budget process to work with Republicans to come up with ways to reduce the overall tax burden of California residents, which is very high. The governor could start by refunding the money to Californians who paid the now suspended fire prevention fee, and by reconsidering the need for his catastrophic gas tax hike.”