Jump In Property Taxes Last Fiscal Year

Sacramento, CA – Californians paid out more in property taxes in the last fiscal year due in part to the real estate boom, according to an annual tally of collections.

The California State Board of Equalization (BOE), which oversees the 58 county assessors who value over 13 million assessments per year, recently released its Fiscal Year (FY) 2020–21 Annual Report. It showed the overall net statewide assessed value for that fiscal year was $7.1 trillion, with $79.9 billion coming from local property taxes. Subtracting from the previous year’s (2019-20) collection of $75.4 billion results in $4.5 billion, or a 6% jump.

“The increase in property tax levies to almost $80 billion is a clear reflection of California’s vibrant real estate market,” said Chair Malia M. Cohen.

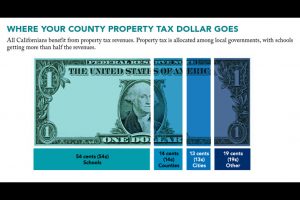

The property tax levies contributed $43 billion to schools and $36.9 billion to local government, with Cohen adding, “As we transition away from the disruptions of the COVID-19 pandemic, I am heartened that these additional property tax revenues will provide significant funding for our schools and critical local government services.”

The assessment and levies must follow the 1978 California voter-approved Proposition 13 that limited property taxes to 1% of the assessed value. The measure also put a cap on the rate of increase for a property’s assessed value, limiting it to an increase of no more than 2% per year unless there is a change in ownership or new construction.

The BOE report also set values for state-assessed properties, which include pipelines, flumes, canals, ditches, and aqueducts that exist within two or more counties and property owned or used by railways or public utilities. In 2021, it was set at $123.2 billion for the 2021–2022 roll, totaling a $3.5 billion increase from the previous fiscal year. According to the report, that also produced $1.94 billion in local property tax revenues in 2021-2022 for the state’s 58 counties.

To view the entire BOE report, click here.