Newsom’s Latest Budget Plan Reflects Sudden Hard Times Hitting Home

Sacramento, CA – Employee pay reductions and deep cuts are in Governor Gavin Newsom’s newly revised budget, a reflection of hard times suddenly hitting home.

In submitting his 2020-21 May Revision budget proposal to the Legislature Thursday, the Governor emphasized that his proposal closes a budget gap of more than $54 billion swiftly brought on by the COVID-19 recession before which the state had a $5.6 billion surplus along with record reserves the state was previously discussing how best to balance.

In his opening remarks, the Governor stated that in nearly the blink of an eye the state had gone from regaling folks about its incredible economic vibrancy and output into having to deal with a historic crisis. Before COVID-19 concerns began to emerge, back in January he recalled that the state was boasting a $3.1 trillion a year economy, the nation’s largest and the fifth-largest economy in the world along with record low employment and job creation.

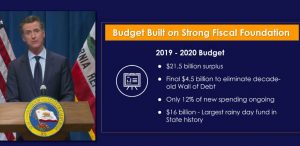

Newsom stressed that while California is entering into a time of uncertainty it is in a much better place than in 2003, or 2009, or 2011 because the state has become even more fiscally conservative by paying off the last of its previous “Wall of Debt,” paying down one-time obligations, reducing ongoing commitments and increasing reserves such as those intended to extend a social safety net, save for economic uncertainty, and invest in public education.

“COVID-19 has caused California and economies across the country to confront a steep and unprecedented economic crisis – facing massive job losses and revenue shortfalls,” Newsom acknowledged. “Our budget today reflects that emergency. We are proposing a budget to fund our most essential priorities – public health, public safety, and public education – and to support workers and small businesses as we restart our economy,” he continued. “But difficult decisions lie ahead. With shared sacrifice and the resilient spirit that makes California great, I am confident we will emerge stronger from this crisis in the years ahead.”

COVID-19 Impacts By The Numbers

The rapid onset of the COVID-19 recession in California has resulted in the filing of more than 4 million unemployment claims since mid-March, and an unemployment rate now projected to be 18 percent for the year. Compared to the pre-COVID January forecast, there is a $41 billion drop in revenues.

With a higher demand for social safety net services due to the pandemic that are increasing state costs, the $54.3 billion deficit is more than three times the size of the record $16 billion set aside in the state’s Rainy Day Fund, which he proposes dipping into annually over the next three years.

The May Revision cancels new initiatives along with canceling or reducing spending included in the 2019 Budget Act. It also draws down reserves, borrows from special funds, and temporarily increases revenues. Newsom added that the most painful cuts will only be triggered if the federal government does not pass an aid package now being spearheaded by House Leader Nancy Pelosi that helps states and local governments.

The Governor stated that negotiations will commence or continue with the state’s collective bargaining units to achieve reduced pay of approximately 10 percent, adding that the May Revision includes a provision to impose reductions if the state cannot reach an agreement. In addition, nearly all state operations will be reduced over the next two years, and nonessential contracts, purchases, and travel have already been suspended.

While the pandemic required an unprecedented shift to telework for state government, it has allowed state managers to rethink business processes, which is resulting in expanded long-term telework strategies, reconfigured office space, reduced leased space, and flexible work schedules for employees when possible.

An Education Needs Balancing Act

Newsom’s May Revision includes $44.9 billion in General Fund support for schools and community colleges and $6 billion in additional federal funds to supplement state funding. It also proposes a new obligation of 1.5 percent of state appropriation limit revenues starting in 2020-21 to avoid a permanent decline in school funding, which grows to $4.6 billion in additional funding for schools and community colleges by 2023-24.

To address the decline in the constitutionally-required funding for schools and community colleges resulting from the COVID-19 recession, the May Revision proposes to reallocate $2.3 billion in funds previously dedicated to paying down schools’ unfunded liability to CalSTRS and CalPERS to instead pay the school employers’ retirement contributions.

It also tags $4.4 billion in federal funding to address learning loss and equity issues exacerbated by the COVID-19 school closures; pay for school modifications; preserve the number of state-funded childcare slots; expand access to childcare for first responders.

Also preserved are community college free tuition waivers and Cal Grants for college students, including the grants for students with dependent children established last year.

Following the release of the May Revision, State Superintendent Tony Thurmond shared, “While the measures outlined in today’s proposal are far from what our schools need, we also understand that our state is facing impossible choices under impossible circumstances.” He somberly pointed out, “In January, Governor Newsom proposed increasing K-12 education spending by $3 billion, the largest per-pupil allocation in state history. By last week, however, revised revenue forecasts estimated $19 billion less in Proposition 98 funding, the minimum guarantee to public schools under state law.”

Family. Public Health, Small Business Support

For hard-hit families living paycheck to paycheck, the May Revision prioritizes funding for direct payments, and maintains the expanded Earned Income Tax Credit, which targets one billion dollars in financial relief to working families whose annual incomes are below $30,000, and includes a $1,000 credit for families with children under the age of six.

It keeps grant levels for families and individuals supported by the CalWORKs and SSI/SSP programs, prioritizing funding to maintain current eligibility for critical health care services in both Medi-Cal and the expanded subsidies offered through Covered California for residents with incomes between 400 percent and 600 percent of the federal poverty level. The proposal estimates unemployment insurance benefits in 2020-21 will be $43.8 billion – 650 percent higher than the $5.8 billion previously estimated before the COID-19 crisis.

The May Revision also targets $3.8 billion in federal funds to protect public health and safety. It also proposes $1.3 billion to counties for public health, behavioral health, and other health and human services programs, and earmarks $450 million for cities to support homeless individuals.

Among the small business provisions, the proposal proposes doubling the small business loan guarantee program to $100 million. To support innovation and the creation of new businesses, it retains January proposals to exempt first-year businesses from the $800 minimum franchise tax. Options are being considered to support job creation such as assistance to help spur the recovery of small businesses and support for increased housing affordability and availability. There is also now a Governor’s Task Force on Business and Jobs Recovery.

Republican State Senator Andreas Borgeas representing the Mother Lode responded to the Governor’s budget that back in January he advised him to take a more fiscally prudent approach, warning him against alarming levels of new spending. “Due to the pandemic, the pendulum has swung from a surplus in the billions to a $54 billion deficit. We must seek ways to ease financial burdens on businesses and provide clear opportunities for the safe reopening of our communities while focusing on Californians’ most fundamental needs,” he stated.